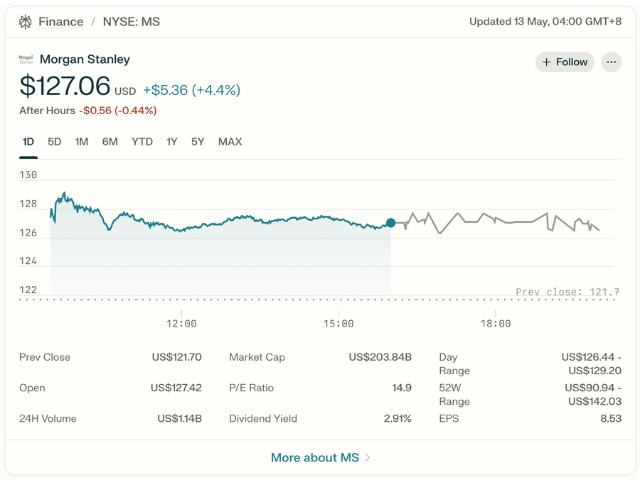

Morgan Stanley Direct Lending Fund (NYSE: MSDL) has priced a public offering of $350 million aggregate principal amount of 6.000% notes due 2030. The notes will mature on May 19, 2030, and may be redeemed in whole or in part at the company's option at any time at par plus a "make-whole" premium. Notably, the notes may be redeemed at par one month prior to their maturity date.

Offering and Use of Proceeds

- The offering is expected to close on or about May 19, 2025, subject to customary closing conditions.

- Net proceeds from the offering are intended to be used to repay outstanding secured indebtedness under existing financing arrangements and for general corporate purposes.

Management and Structure

- The offering is managed by a syndicate of financial institutions, including SMBC Nikko Securities America, Inc., BNP Paribas Securities Corp., RBC Capital Markets, LLC, Truist Securities, Inc., Wells Fargo Securities, LLC, ING Financial Markets LLC, J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, MUFG Securities Americas Inc., and Regions Securities LLC as joint book-running managers.

- Several other firms are acting as co-managers.

About MSDL

- Morgan Stanley Direct Lending Fund is a non-diversified, externally managed specialty finance company focused on lending to middle-market companies.

- MSDL is regulated as a business development company under the Investment Company Act of 1940 and is externally managed by MS Capital Partners Adviser Inc., an indirect, wholly owned subsidiary of Morgan Stanley.

- Importantly, MSDL is not a subsidiary of or consolidated with Morgan Stanley.

Credit Rating

Investor Considerations

Potential investors are advised to carefully review the investment objectives, risks, charges, and expenses associated with MSDL. The pricing term sheet, preliminary prospectus supplement, and accompanying prospectus have been filed with the U.S. Securities and Exchange Commission (SEC) and should be reviewed before investing. These documents are not offers to sell or solicitations to buy securities where such actions are not permitted.

Summary Table

This issuance reflects MSDL’s ongoing strategy to manage its capital structure and support its lending activities in the middle-market segment.

How Does MSDL’s 6% Coupon Compare to Other BDCs?

Relative Coupon Analysis

- MSDL’s 6.000% coupon on senior unsecured notes due 2030 is in line with, or slightly below, recent BDC unsecured debt offerings. For example, Goldman Sachs BDC issued 6.375% notes due 2027, and recent BDC debt issuance has generally ranged from about 6% to 7% for similar maturities and credit profiles.

- Market context: BDCs have been able to issue unsecured debt at relatively tight spreads in late 2024 and early 2025, but spreads have recently started to widen2. The volume of unsecured BDC debt issuance has been high, reflecting strong investor demand and competitive pricing.

Aggressiveness of Pricing

- MSDL’s 6% coupon is considered conservative to moderate for a BBB-rated BDC in the current environment. It is not aggressive (i.e., not unusually low), given that comparable BDCs have priced slightly higher for shorter maturities (e.g., GSBD at 6.375% for 2027). The pricing reflects MSDL’s solid credit profile and the still-favorable, though tightening, market conditions for BDC debt.

- Recent spread widening suggests that future BDC debt may price higher, so MSDL’s timing likely secured a favorable rate before further market shifts.

Source: cbonds.com, lsta.org

What Types of Middle Market Deals Is MSDL Targeting?

Target Borrowers and Deal Types

- MSDL focuses on directly originated senior secured term loans to U.S. middle market companies. These are typically first lien, floating rate loans, and the fund emphasizes a defensive portfolio construction with a preference for non-cyclical sectors.

- Middle market definition: Companies with EBITDA between $10 million and $200 million, and revenues from $20 million to $1 billion, are typical targets.

Industry Focus

- MSDL and similar direct lending BDCs currently avoid deeply cyclical, capital-intensive businesses. Instead, they prioritize non-cyclical industries such as:

- This approach is designed to maintain stable cash flows and lower default risk through market cycles.

Loan Sizes

- Typical loan sizes for middle market direct lending range from $20 million to $200 million, depending on the borrower’s size and financing needs.

- MSDL’s recent quarterly activity included new investment commitments of $233.4 million, which likely represents multiple transactions within this size range.

Summary Table: MSDL’s Positioning

Sources: msdl.com, Morgan Stanley Publication Evolution of Direct Lending 2025, Morgan Stanley Private Credit Outlook 2025

Takeaway:

MSDL’s 6% coupon is moderately priced for the current BDC market, reflecting its strong credit profile and the competitive, though tightening, environment for unsecured BDC debt. The fund will use the new capital to continue targeting senior secured loans to middle market companies, focusing on non-cyclical sectors and deal sizes typical for this segment.

Our Opinion

This strategic move by Morgan Stanley distinctly sets institutional players apart from smaller entities scrambling for deals. While others are struggling to secure capital at much higher costs, MSDL capitalizes on its banking relationships to secure 6% fixed-rate funding through 2030—a privilege most alternative lenders can only dream of in today's market.

The transition to unsecured debt underscores the stark contrast between the "haves and have-nots" in the alternative lending sector. Many lenders are still burdened with heavy collateral requirements, while these Wall Street-backed BDCs operate under different conditions.

Nevertheless, their success serves as a testament to the effectiveness of the alternative lending model. Morgan Stanley's significant commitment reinforces the legitimacy of what alternative lenders do in the eyes of investors. Although some lenders may envy MSDL’s funding edge, this rising tide will eventually benefit all, even if some have to work harder to keep pace.

Headlines You Don’t Want to Miss

Fed survey finds tighter standards, weaker demand for loans in first quarter

U.S. banks tightened lending standards and reported weaker demand for commercial and industrial loans across firms of all sizes in the first quarter of 2025, according to the Federal Reserve’s latest Senior Loan Officer Opinion Survey. While credit standards for most residential mortgages remained unchanged, demand for these loans declined, with the exception of a slight uptick in home equity lines of credit, reflecting broader economic uncertainty and cautious consumer behavior.

LPRO Investors Have Opportunity to Lead Open Lending Corporation Securities Fraud Lawsuit

Investors in Open Lending Corporation (NASDAQ: LPRO) who purchased shares between February 24, 2022, and March 31, 2025, have the opportunity to seek appointment as lead plaintiff in a securities fraud class action lawsuit, with a deadline to file by June 30, 2025. The lawsuit alleges that Open Lending and its executives misrepresented the effectiveness of their risk-based pricing models, issued misleading statements about profit share revenue, failed to disclose significant devaluation in 2021 and 2022 loans, and misrepresented the underperformance of 2023 and 2024 loans, resulting in substantial investor losses when these issues came to light.

DeFi lender Aave reaches $40B in value locked onchain

DeFi lending protocol Aave has reached a record $40.3 billion in total value locked (TVL) onchain as of May 12, 2025, marking the highest TVL ever recorded across decentralized finance platforms. This milestone was driven by increased user deposits and a surge in the price of Ether, with Aave v3 accounting for the majority of the locked value.

.png)